FIRE three years in: Break Downs, SWRs, Work and other musings

Holy shit! Has it been three years already? These FIRE anniversaries seem to creep up on me out of nowhere. But I indeed have another Fireversary coming up this week, which is a great chance to look back and reflect.

I wrote about my first year of FIRE here and here and my second year of FIRE here.

Those posts on one hand feel like they were written ages ago and at the same time I have a hard time believing that another year has gone by just like that. Bam.

I am writing this post from Grand Portage MN, where we broke down once more with Harry, our RV.

This is our second break down of the year. The first occurred on our very first drive in 2019 after spending the Winter in Phoenix and Germany.

Luckily we did have roadside assistance, unlike in 2018. So since Year #3 of FIRE started last August, we spent about 3 weeks camped out in a repair shop in Quartzsite AZ in January and now it’s been 9 days in MN so far. At least this time we did not need a tow and could limp to a nearby gas station, where a friendly local is helping us to repair the Motorhome once the parts we ordered come in. Of course DHL had to lose one of our packages so at this point it is quite uncertain when we’ll be back on the road.

If I have learned one thing from the previous three break downs (and this fourth one is no different) everything always takes twice as long, parts never arrive when they are supposed to arrive and if they do arrive in time, chances are one or several parts won’t fit.

On the bright side, the folks at the gas station have been super nice, letting us hang out in the parking lot. We have a smidge of a lake view (Lake Superior) and we have had rainbows on a couple of occasions. Also, getting stuck here allowed us to attend a Pow Wow of the Grand Portage Band of Lake Superior Ojibwe as well as the Grand Portage Rendezvous Days, two amazing events, we would have otherwise missed. Things could be a lot worse.

Hopefully this will be it in terms of breakdowns for a while. It’s kinda getting old. I mean it’s good to have an emergency fund and we did expect having to have some repairs, but it would be nice to not touch the efund for a while, especially after all the other things that added to the budget in year three: broken glasses, dental work, several trips to Germany, travel paperwork, flights and extra vet costs for the cats, various RV repairs and on and on and on….

Most of these were somewhat expected and planned for to an extent, but it’s never fun when they do happen. Having a buffer in your FIRE budget, especially if you are LEAN FIRE, makes all the difference.

The plan, so far is still working. But I have also seen expenses creep up every year since I stopped working. I had planned on ideally staying as close to 3% as possible and not taking the inflation adjustment in the first few years, but sometimes stuff just happens.

Withdrawal rates

As expenses have been creeping up, although still within reason, I have given SWRs and safest WRs a bit more thought. I have done a lot of reading around “failsafe” projections and ideas, to challenge my 3-3.5% assumption and to make sure my plan is still solid, while I still have time to make adjustments if needed.

I am not freaking out yet, but I also want to make sure I am staying on top of things. I have found some really great reading in Big ERN’s withdrawal rate series, as well as tenfactorialrocks’ dynamic SWR idea (he is not updating his blog anymore, unfortunately, but still has a lot of great content).

Be ready to go down a rabbit hole following those links. Big ERN’s series now has over 30 posts and counting, debunking all kinds of myths including cash buffers and part time work, just to name a couple of popular ones.

I found10!’s dynamic rate idea appealing, because it takes into account the current valuation environment:

SWR = 1.0% + 0.5 * (1 / CAPE)

When I did my last portfolio evaluation back in July (I am lazy and do those once a year now), CAPE was at 30.35, resulting in a 10! dynamic SWR of 2.65% of CURRENT stash.

What I found interesting, is that it would have given me a lower total amount in 2016 when I FIREd, but each year after that the actual total amount would have been quite a bit higher than with the traditional approach (3% of original stash plus inflation adjustment). This year his approach would have given me a couple thousand extra $$ to spend, if I were to follow that path.

I am certainly not looking for reasons to spend more. I am just trying to make sure my 3-3.5% are still conservative enough in our current environment for my time horizon (45+ years). So for the time being I have decided to keep sticking to my original plan, as close to 3% as possible and not exceed 3.5% as in the past. But I’ll also check against the dynamic SWR number (of current portfolio) to see if my 3% (of initial portfolio) may be too high during any given year.

To work or not to work?

I have been in touch with several of my former colleagues over the past three years. Whereas I still think my former employer overall is a great company with an appealing mission, I still hear about a lot of the political BS, putting a huge damper on their fun. Some of the stories former colleagues have shared have very much reassured me that my exit timing was right. Even if it weren’t, not much I could change about that right now.

What is weird, is that I still do feel the itch to work sometimes. But then I sit down and snuggle with a cat or two and it passes quickly, LOL!

On a serious note though, my initial plan was to volunteer more and support causes that I am passionate about. And it seems the list of causes I am passionate about has gotten longer and longer whereas the time I can actually spend doing something for them is mostly limited to the last 2.5 months of the year, due to being on the road the rest of the year.

With this years’ expenses so high, I also am worried I may end up not hitting my 30% target (30% of expenses have been donations in the past). The total amount will probably be on par with last year, but with higher expenses the percentage may end up lower and that’s something that really bugs me (I am weird that way).

For this reason I have been toying with the idea to find a job (gasp), so I can up those donations. No, this blog is not making any money, although I do have a few affiliate links. The amount of work it would take to run this thing more professionally would mean I’d have to focus on too many things that would make blogging a lot less fun for me. So I don’t expect any major changes in blog income. If you’d like to prove me wrong though, go ahead, here’s the link to those affiliate links 😉

The thing is, that I am quite picky with what kind of job I would be willing to take. In the last three years I have been obsessing over brainstorming “things to do for money, while on the road” and “things to do for money, while stationary in Phoenix” in case I ever needed it. After reading through tons of gigs and jobs posted on Craigslist, Indeed, in RVer FB groups and the like, I am kind of appalled.

No, actually I am outraged in solidarity with anyone who ever really needed a job. I mean, people expect applicants to have an endlessly long list of skills, including but not limited to walking on water, be available at all times, give up all your personal info, allow them to run a background check etc. although they are hardly disclosing anything about their own company and work environment themselves and then they want to pay you next to nothing.

On the other hand you have all the “make money from home” scams, where the people touting those sign up links make all the money and expect you to give up all your personal info without ever knowing if you’ll ever make anything from all the time put in. I actually have a couple of ranty posts about those in the draft folder. I probably should publish one of those sometime? Or rather not?

Maybe my standards are too high, or I am looking in the wrong places. But the realities of finding a job in FIRE are not as rosy as many people make them out to be.

At this point, as I don’t “need” a job, I am very careful about how I want to trade my time for money. When I am in Phoenix for the winter, I want to be able to volunteer at the charities I care about. I also want to spend time with my non-Fire friends, therefore I don’t want to have to commit to work on weekends. That rules out most retail places, where it would be easy to find something for the holiday season.

I also would like to do something fun and interesting, where I’d help out a great cause, or can learn something new. I could imagine a wide range of options, but so far nothing has come up that got me really excited.

I am reliable, dependable, teachable, reasonably well organized, don’t mind to work hard, have a bunch of transferable skills and love to add value to wherever I work, no matter what job, but it seems that that’s not what counts anymore. It has been kind of frustrating to be honest. I know I sound like an entitled brat, or someone who’d find a reason to turn down any kind of work, but I assure you that’s absolutely not true.

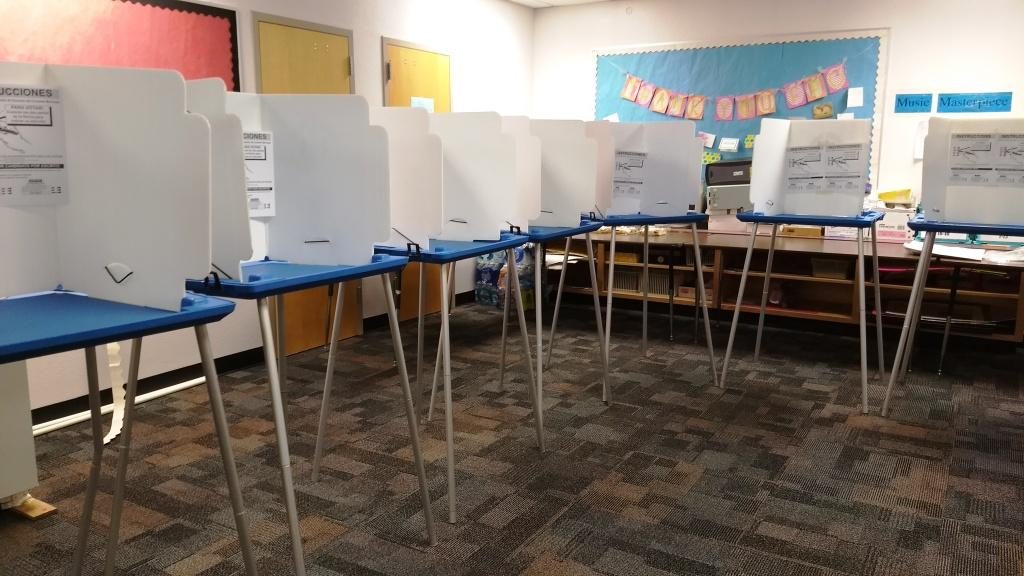

In November 2018 I took a job as an election worker. At $10ish hour, that’s not the kind of thing where you are in it for the money, but it’s something that interested me and I learned a lot from that experience. I enjoyed the work on election day, the interaction with other board workers, the voters and also setup and breakdown.

I even had fun with the ballot counting work in the following weeks (AZ had a couple of tight races, which is why we were counting ballots for an extended period of time). I was mostly assigned to evaluating duplicates. We were always teamed up with a person of another party affiliation. That in itself was an interesting experience for sure. I made a whopping $414 during that month, most of which went right to my favorite pet rescue organization, with a small amount helping out someone in need on a personal level.

Even if I had kept that money, it would not have made any significant difference in my WR, not even in my leanFIRE world. So don’t count me out from the living off the stash crowd, just because I “worked”.

On election day we had to be at the polling place at 5am, which meant getting up way before my furry alarm clocks purr me awake, so I had to use a real alarm clock. Uggg that beep beep beepping sound. Crawl out of bed, make coffee and drive to a place to do what someone else tells me to do. That was an interesting reminder of life in the olden days. But I didn’t mind all that much, because I was excited about the new experience. I would like really like to work the 2020 election as well.

For this winter season I am still flip flopping between starting a business I have been wanting to start for a long time or finding some meaningful and interesting work to make a little money. Not to reduce my WR, but to have more money to give away.

Its’ a bit frustrating, because had I spent the same amount of time working a minimum wage job, as I did (and do) searching for the right thing to do, I’d already have a ton of money to donate. Luckily I am in a position where I can be very selective about what I would spend my time on. Most likely I will end up doing some volunteer work with various Phoenix non-profits and some pet food bargain hunting for my favorite rescues, until I discover that unicorn of a job I am looking for.

Health, Fitness and Personal Growth

The reoccurring theme I have mentioned in all previous Fireversary posts for me still is, stuff does not happen in FIRE unless I make it happen. Yeah, that still very much applies. Have not found a magic wand yet for weight loss and better fitness. It’s hilarious though, because there are so many parallels to FIRE. Like live below your means, aka spend less money than you make. Same story with weight loss. Eat less calories than your body needs, by either watching what you eat or burning more through exercise or both. Really same pricinciple. But whereas I was always good at keeping my shit together financially, when it comes to nutrition, not so much.

When I go to bed at night I am that person, who is determined to eat healthy and stay away from temptations the next day. I will work out and get shit done. Then I get up the next morning and am no longer that same person. I’ll be real good at that eating healthy thing for the most part and pretty good at staying away from temptations, but come 8pm, literally on the final stretch, I give in to the chocolate cravings, like a shopping addict has to have their next gadget. Still working on that! I really wish I could figure out how to apply my fiscal discipline to food.

At one point a few years back, I lost 44 pounds, slowly over 18 months, by changing habits little by little. I even kept it off for almost two years. People constantly were asking for my secret and what I was doing. That always made me chuckle. The thing is, there is NO secret. It’s a well known fact that fruits and veggies have a lot less calories per ounce than chocolate or ice cream. Duh. It’s also a well known fact that exercise can really help you keep in shape. I KNOW all that stuff, so that’s not the issue. And I have been able to successfully apply that knowledge in the past. What is so hard about that? Especially for someone who does have the discipline in other areas. I don’t know, I haven’t figured it out yet, but I won’t give up. I want to get back to creating healthy habits.

Oh look, carrot cake muffins!

One thing I am proud of though, is having held up a daily Yoga habit since March. Some days, that will mean a variation of this five minute yoga sequence or this 10 minute one and some days that may mean a more sophisticated yin yoga or flow practice. That certainly has helped me tremendously, especially during that challenging time in Germany earlier this year. My favourite sources for awesome Yoga videos are Yoga with Adriene and Yoga with Kassandra. I am sure there’s lots of other great ones, but those two already have a huge variety of videos and I just love the way they guide you through them.

National Parks and Reading List

We are up to 29 National Parks, about 48 National Monuments/National Historic Sites and countless State Parks. Between the two of us we have been to quite a few more individually before we met, but we reset to zero when we started visiting them together. Obviously, when you break down a lot, you are not making a ton of progress. But we are also taking it slow and spending as much time as we like at each one we do visit, instead of just checking them off the list as quickly as possible.

We recently spent six days in various areas of Theodore Roosevelt National Park, where I came across the famous quote from Theodore Roosevelt’s speech “Citizenship in a Republic”, also often referred to as “Man in the arena Speech”.

“It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better.

The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly…”

He delivered this speech at the Sorbonne in Paris, France on April 23rd 1910. The above quote, which made the speech famous, also inspired Brené Brown’s book, “Daring Greatly”. That book has been on my reading list for a very very long time. So our visit at Theodore Roosevelt NP seemed like an appropriate time to finally start reading it.

In terms of reading, I made a bit of progress on my reading list in the past year, not as many books as I wanted to, but still a good amount. I am not going to mention all of them, but there were a couple that had some life changing potential, that I’d like to share

A friend commended Dr. Sarno’s books The Mindbody Prescription, The Divided Mind and Healing Back Pain. There is also a documentary called All The Rage, you can stream on demand, if reading is not your thing.His concept sounds a bit woo woo at first, but keep an open mind and look into them if you are interested in dealing with pain in a different way. I have been able to improve some long time issues, where other methods failed. That’s all I am going to say.

Speaking of long time issues, I also came across Jonice Webb’s books Running on Empty and Running on Empty No More for various reasons. Going back to your childhood home in the town you grew up in, to live with a parent for an extended amount of time as an adult can do a weird number on you, bringing up some old shit. Without going into too many personal details, those books have helped made sense of a lot of things.

Another friend recommended Brenda Ueland’s book If You Want to Write, to help me deal with my hesitation to publish what I have been writing. It was a quick and fun read, but I did not find it all that helpful, to be honest.

I also gifted a friend The Simple Path to Wealth, but not without flipping through it, one more time before giving it away 😉 Just couldn’t help myself. Not sure if that counts as reading it again. But it’s a book I still enjoy spending time with and the one I recommend most to people interested in the concept of FIRE.

Plans going forward

Whew, this was a long post already and you know what they say about the best laid plans…so the plan right now is to not make all that many plans.

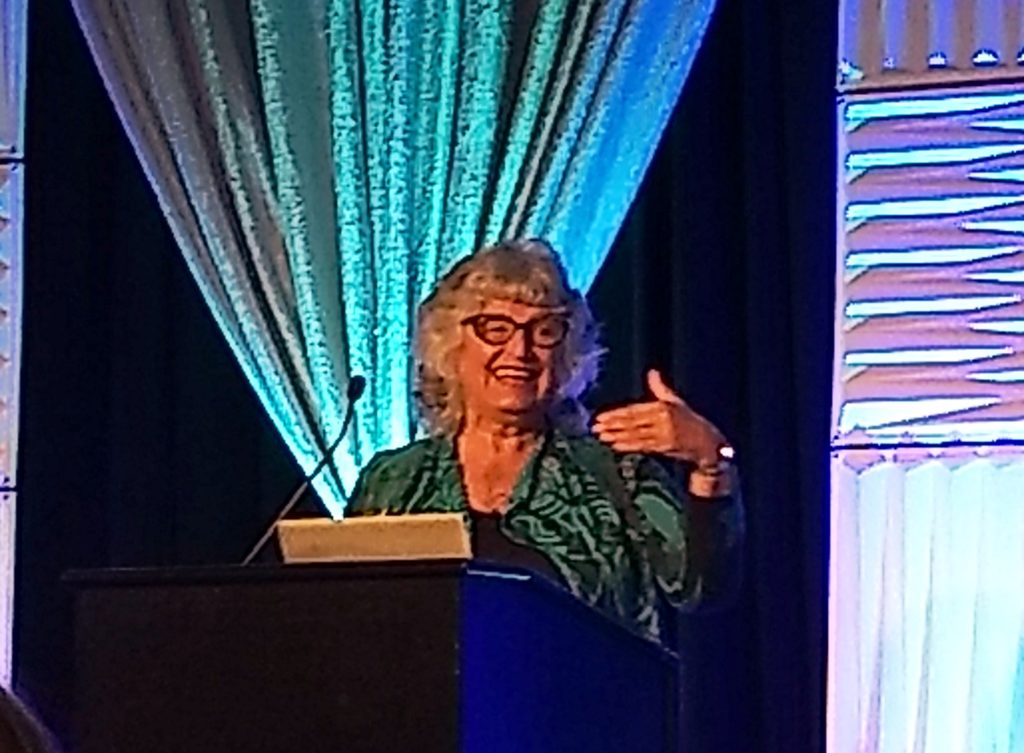

One of the highlights of this past year, was hearing Vicki Robin (author of Your Money or Your Life) speak live in person back in June. I happened to be at the right place at the right time, nothing I could have planned for, really. I hope I can be at the right place at the right time more often. Her speech reminded me of a lot of things I still want to accomplish with my freedom, including looking into some alternative investments.

Other than that, I think I’ll try my best to stay FIREd and reasonably happy, spend time on what matters most and try my very best to worry less and focus on my circle of influence. As simple as that may sound, it’s not always easy in our current environment.