Finding financial advice in unexpected places!

Today TDA and I visited Mount Rushmore National Memorial. It has been on my places-I-want-to-visit-list for a very long time. We leisurely strolled along the trail that took us to the artist studio via various viewing platforms and made it back to the visitor centre just in time when a major hailstorm came in.

We usually enjoy looking at exhibits thoroughly and learning about the history of a particular place. It is one of the benefits of being a permanent traveler and FIRED to just take the time you need at any given location, without having to rush to the next place.

Now with the hail and rain outside, we took our time even more than we usually do to study every little nugget of interesting information.

In our almost 10 months of slow travelling the country, we have seen many references to the Civilian Conservation Corps (CCC) and some to the Federal Emergency Relief Association (FERA also referred to as the SheSheShe camps) and are always in awe about the accomplishments of the women and men during those difficult times and their roles in the history of this country. On our travels, we still benefit a lot from their work today.

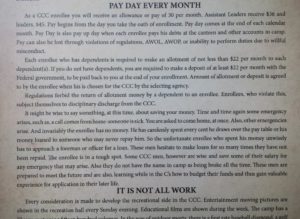

I expected a solid history lesson, which we definitely did get. While taking in the exhibits at the visitor center I also came across a display showing a “CCC Handbook For The New Recruit”. I started to read and was quickly captured by some of the contents featuring good advice for new recruits, including the following:

- a suggested 73% savings rate ($22 out of a $30 salary) based on the lowest salary, or a 48% savings rate based on the highest salary

- the significance of an emergency fund

- the strong recommendation to stay out of debt

- and last but not least the importance of budgeting skills

Sounds familiar, huh? Who would have thunk! Somehow that basic knowledge of financial literacy got buried for many years, until the Great Recession made it interesting / fashionable / necessary again.

Personally, I was fortunate to have most these things instilled at a young age by a very frugal upbringing, but that alone is not enough. I was doing a decent job, saving and budgeting, but failed miserably when it came to investing. I wish, some solid investing advice like Jim Collins’s book, The Simple Path to Wealth: Your road map to financial independence and a rich, free life, had been available to me earlier in life.

Just imagine you had had a 73% savings rate during Great Depression and were also able to access some great investing advice at the time, how much your funds would have grown and what kind of a legacy you could have left……Ok, ok, most of us were not around back then, but still: just imagine for a moment!

Don’t get me wrong, I am insanely grateful to live in today’s times with all the information available to us at our fingertips and all the creature comforts we enjoy. I truly hope, none of us have to live through similar hardships anymore as people had to during the Great Depression, unless someone, for whatever reason, chooses to. Even if you were Rockefeller, you’d live a better life today then he did back in the time, as suggested by this recently published article, much discussed in the FIRE community.

Hopefully we’ll learn our lessons.

In case you are interested in the entire CCC Handbook For The New Recruit, I found an online version of the full CCC Handbook as a PDF to download for free here, maybe they should consider selling them at the Eparks Online store, along with other important financial literacy books, such as Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence: Revised and Updated for the 21st Century and The Simple Path to Wealth: Your road map to financial independence and a rich, free life.